Senate sets stage for tough action against counties with undeclared bank accounts

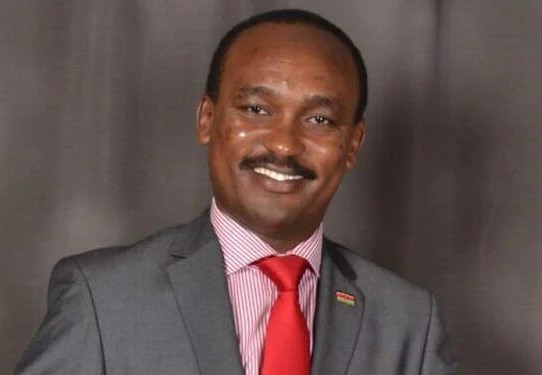

The committee, chaired by Wajir Senator Mohamed Abass, wants the Public Finance Management (National Government) Regulations, 2015, revised to spell out clear penalties for counties and officers who fail to declare or close illegal accounts.

The Senate has unveiled a tough plan to curb financial malpractice in county governments by tightening oversight of commercial bank accounts and imposing stiff penalties for non-compliance.

This comes amid revelations that counties have been secretly running thousands of accounts outside the legal framework, raising fears of misuse of public funds.

More To Read

- Parliament seeks Controller of Budget control of Sh63 billion Housing Levy to curb misuse

- Senate convenes special sitting to hear Governor Nyaribo’s impeachment charges

- Why City Hall moved hospital accounts to Sidian Bank- Sakaja

- Senate summons Isiolo, Kericho governors for skipping audit hearings

- Revenue gaps, budget misalignments hurting service delivery, warns Auditor General

- Governance Committee orders mandatory audit attendance for university heads

The Devolution and Intergovernmental Relations Committee has recommended far-reaching amendments to financial regulations to ensure full transparency and accountability.

The proposed changes seek to give the Controller of Budget, Auditor-General and Central Bank of Kenya real-time, unrestricted access to all county-operated bank accounts.

The committee’s findings follow an inquiry into the widespread opening and operation of unauthorised commercial bank accounts by counties.

Controller of Budget Margaret Nyakang’o revealed that counties are holding over 5,400 irregular accounts, a figure that has triggered alarm over potential loss of billions of shillings through unregulated transactions.

The committee, chaired by Wajir Senator Mohamed Abass, wants the Public Finance Management (National Government) Regulations, 2015, revised to spell out clear penalties for counties and officers who fail to declare or close illegal accounts.

“This is aimed at strengthening oversight, enhancing transparency, and safeguarding public resources,” the report states.

The committee has further directed the Auditor-General to carry out a full audit of all commercial bank accounts held by counties within six months of the report’s adoption. Any dormant accounts will be shut down, and the funds transferred to the County Revenue Fund.

“Within six months of the adoption of this report, the Office of the Auditor-General shall conduct a comprehensive audit of all commercial bank accounts operated by county governments,” the report reads.

Senators began their probe after successive Auditor-General reports exposed long-standing gaps, weak controls, and poor disclosure practices around county commercial bank accounts. These loopholes have made it difficult to keep accurate financial records and track the flow of public money.

The committee noted that while the Public Finance Management Act, 2012, allows county treasuries to open and operate accounts, this authority has often been misused.

Sections 119(1) and 119(2) of the law provide for the establishment of a County Treasury Single Account at the Central Bank or another approved bank for all county payments, as well as controlled opening of additional accounts.

However, some counties have circumvented these requirements, creating undisclosed accounts and exposing funds to misuse.

“This discrepancy indicates instances of non-disclosure of bank accounts to the Auditor-General and the Controller of Budget, thereby posing a risk to the existence of a reliable and verified inventory of all commercial bank accounts held by county governments,” the committee warns.

According to the report, the situation has been worsened by conflicting provisions in financial regulations and donor conditions that often require separate project accounts.

Regulation 82(1)(a) of the national regulations allows exemptions for donor-funded projects, revenue collection, and areas without Central Bank branches.

Meanwhile, Regulation 82(1)(b) of the county regulations only permits petty cash imprest accounts in commercial banks, limiting how counties can manage donor and operational funds.

The Senate now wants the legal framework streamlined to remove these inconsistencies and ensure stricter control of county finances, in a bid to close loopholes that have persisted for years.

Top Stories Today